Listed below are other things you can do to lower your insurance coverage expenses. Costs differ from company to company, so it pays to shop around. Get at least 3 estimate. You can call companies straight or access information on the Web. Your state insurance coverage department might also provide contrasts of prices charged by major insurance companies. You purchase insurance to safeguard you financially and offer assurance. It's essential to choose a business that is economically steady. Inspect the financial health of insurer with ranking business such as AM Finest (www. ambest.com) and Requirement & Poor's (www. standardandpoors.com/ratings) and seek advice from consumer publications.

Some sell through their own representatives. These agencies have the very same name as the insurance provider. Some sell through independent agents who provide policies from several insurance provider. Others do not use agents. They offer straight to consumers over the phone or through the Web. Don't shop by cost alone. Ask buddies and family members for their suggestions. Contact your state insurance department to discover out whether they supply info on consumer grievances by business. Select an agent or company representative that makes the effort to answer your questions. You can use the list on the back of this pamphlet to help you compare quotes from insurance companies.

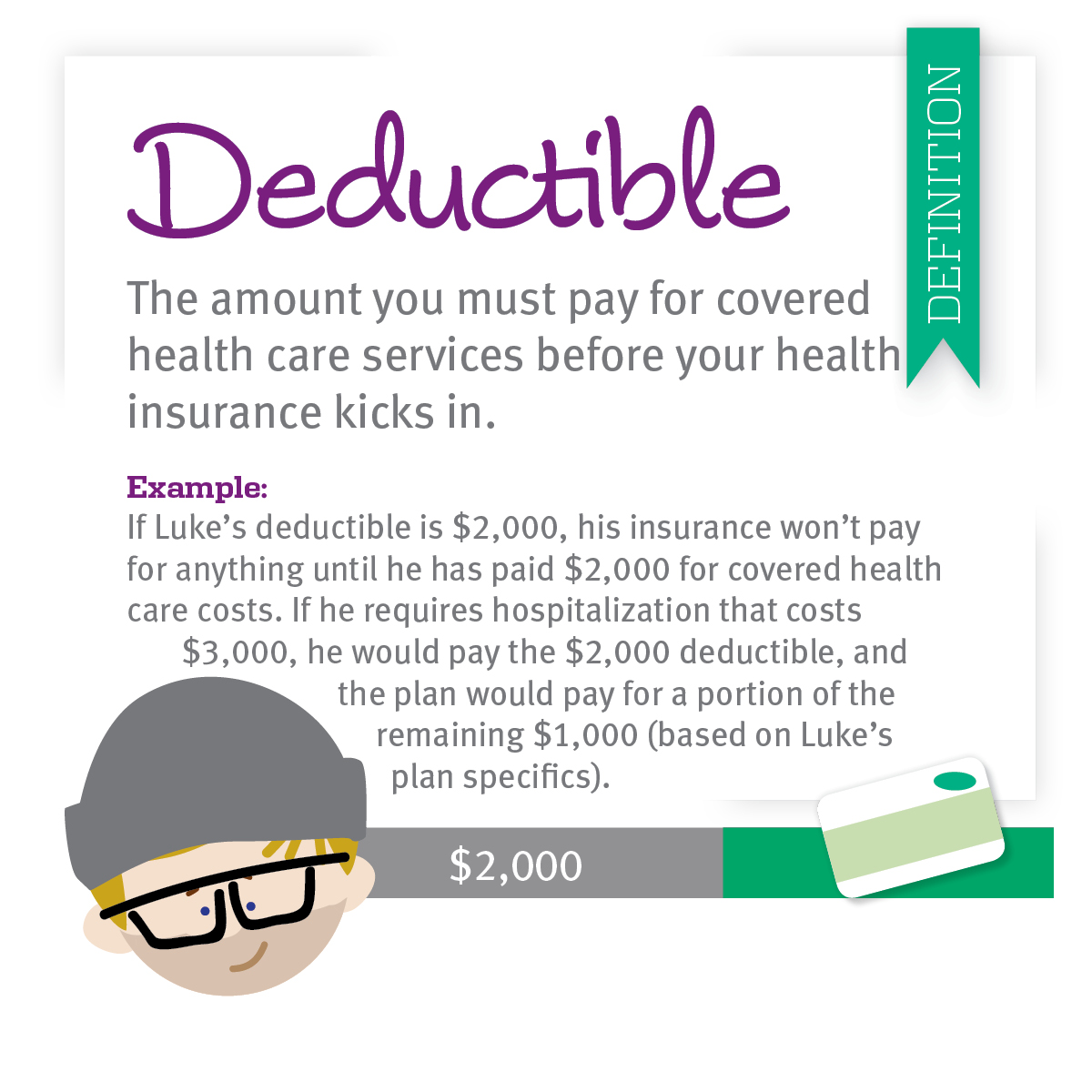

Vehicle insurance premiums are based in part on the vehicle's price, the expense to fix it, its total safety record and the probability of theft. Many insurance companies provide discount rates for functions that decrease the risk of injuries or theft. To help you decide what automobile to buy, you can get info from the Insurance Institute for Highway Security (www. iihs.org). Deductibles are what you pay prior to your insurance plan kicks in. By requesting higher deductibles, you can reduce your expenses considerably. For instance, increasing your deductible from $200 to $500 could lower your accident and comprehensive coverage expense by 15 to 30 percent.

Prior to choosing a greater deductible, make sure you have actually adequate money reserved to pay it if you have a claim. Think about dropping collision and/or thorough coverages on older cars and trucks. If your car is worth less than 10 times the premium, purchasing the protection may not be cost efficient. What is cobra insurance. Auto dealers and banks can inform you the worth of cars and trucks. Or you can look it up online at Kelley's Directory (www. kbb.com). Evaluation your protection at renewal time to ensure your insurance requirements have not changed. Numerous insurance companies will provide you a break if you buy two or more kinds of insurance.

The 5-Minute Rule for How To Get Rid Of Mortgage Insurance

Some insurance providers decrease the rates for long-time clients. But it still makes sense to search! You may conserve cash purchasing from various insurance provider, compared to a multipolicy discount. Developing a solid credit rating can cut your insurance costs (What does homeowners insurance cover). A lot of insurance providers use credit information to rate vehicle insurance coverage. Research reveals that individuals who efficiently handle their credit have less claims. To safeguard your credit standing, pay your bills on time, do not obtain more credit than you require and keep your credit balances as low as possible. Examine your credit record on a routine basis and have any errors remedied without delay so that your record stays precise.

Low mileage discounts can likewise use to motorists who car swimming pool to work. Some business provide reductions to motorists who get insurance through a group strategy from their companies, through expert, business and alumni groups or from other associations. Ask your company and inquire with groups or clubs you are a member of to see if this is possible. Companies provide discount rates to policyholders who have actually not had any mishaps or moving violations for a variety of years. You might likewise get a discount if you take a defensive driving course. If there is a young motorist on the policy who is a great trainee, Proprietor insurance coverage covers property or industrial home that is rented to tenants. It likewise covers the landlord's liability for the occupants at the home. Most property owners' insurance, meanwhile, cover only owner-occupied homes and not liability or damages connected to occupants. Marine insurance and marine freight insurance cover the loss or damage of vessels at sea or on inland waterways, and of freight in transit, despite the technique of transit. When the owner of the cargo and the carrier are different corporations, marine cargo insurance coverage normally compensates the owner of freight for losses sustained from fire, shipwreck, etc., however leaves out losses that can be recuperated from the provider or the provider's insurance.

Tenants' insurance, typically called renters' Helpful hints insurance coverage, is an insurance plan that provides some of the advantages of homeowners' insurance coverage, but does not include protection for the residence, or structure, with the exception of little alterations that a renter makes to the structure. Supplemental natural catastrophe insurance covers specified costs after a natural disaster renders the policyholder's home uninhabitable. Periodic payments are made straight to the guaranteed up until the home is rebuilt or a defined period has elapsed. Surety bond insurance coverage is a three-party insurance coverage ensuring the performance what is a timeshare presentation of the principal. Volcano insurance coverage is a specialized insurance coverage safeguarding versus damage arising particularly from volcanic eruptions.

Liability insurance coverage is an extremely broad superset that covers legal claims against the insured. Numerous types of insurance coverage consist of an aspect of liability coverage. For instance, a house owner's insurance plan will typically include liability protection which safeguards the guaranteed in case of a claim brought by somebody who slips and falls on the home; automobile insurance coverage also includes an aspect of liability insurance that indemnifies versus the harm that a crashing cars and truck can cause to others' lives, health, or residential or commercial property. The security offered by a liability insurance policy is twofold: a legal defense in case of a suit begun against the insurance policy holder and indemnification (payment on behalf of the insured) with regard to a settlement or court verdict.

Public liability insurance or general liability insurance coverage covers an organization or organization against claims need to its operations injure a member of the general public or harm their home in some way. Directors and officers liability insurance (D&O) protects a company (normally a corporation) from expenses associated with lawsuits resulting from mistakes made by directors and officers for which they are responsible. Environmental liability or ecological disability insurance coverage protects the guaranteed from bodily injury, residential or commercial property damage and clean-up costs as an outcome of the dispersal, release or escape of toxins. Mistakes and omissions insurance coverage (E&O) is service liability insurance coverage for specialists such as insurance coverage representatives, property agents and brokers, architects, third-party administrators (TPAs) and other business experts (What is an insurance deductible).

Examples would consist of using rewards to participants who can make a half-court shot at a basketball game, or a hole-in-one at a golf competition. Expert liability insurance, likewise called professional indemnity insurance (PI), protects insured professionals such as architectural corporations and medical practitioners versus possible carelessness claims made by their patients/clients. Professional liability insurance might take on various names depending on the profession. For instance, professional liability insurance coverage in referral to the medical occupation might be called medical malpractice insurance. Frequently an industrial insured's liability insurance program includes a number of layers. The very first layer of insurance generally includes main insurance coverage, which offers very first dollar indemnity for judgments and settlements as much as the limits of liability of the primary policy.

Not known Incorrect Statements About How Much Is Pet Insurance

In many circumstances, a business insured may elect to self-insure. What is renters insurance. Above the main insurance or self-insured retention, the insured might have one or more layers of excess insurance to supply protection extra limits of indemnity defense. There are a variety of kinds of excess insurance, including "stand-alone" excess policies (policies which contain their own terms, conditions, and exemptions), "follow type" excess insurance (policies that follow the terms of the underlying policy except as specifically offered), and "umbrella" insurance coverage (excess insurance that in some circumstances might provide protection that is more comprehensive than the underlying insurance coverage). Credit insurance repays some or all of a loan when the customer is insolvent.

Mortgage insurance coverage is a kind of credit insurance coverage, although the name "credit insurance coverage" more frequently is utilized to describe policies that cover other type of debt. Numerous charge card use payment defense strategies which are a form of credit insurance. Trade credit insurance is business insurance coverage over the receivables of the insured. The policy pays the policy holder for covered receivables if the debtor defaults on payment. Collateral defense insurance coverage (CPI) guarantees property (mostly automobiles) held as security for loans made by loan provider. All-risk insurance coverage is an insurance coverage that covers a wide variety of events and dangers, other than those kept in mind in the policy.

In vehicle insurance, all-risk policy includes also the damages triggered by the own motorist. High-value horses might be guaranteed under a bloodstock policy Bloodstock insurance covers individual horses or a variety of horses under common ownership. Coverage is generally for mortality as an outcome of accident, health problem or illness but might encompass consist of infertility, in-transit loss, veterinary fees, and potential foal. Organization interruption insurance coverage covers the loss of earnings, and the costs incurred, after a covered hazard interrupts typical organization operations. Defense Base Act (DBA) insurance supplies protection for civilian workers hired by the federal government to carry out agreements outside the United States and Canada.

people, U.S. residents, U (How does insurance work).S. Permit holders, and all staff members or subcontractors hired on abroad government agreements. Depending on the nation, foreign nationals need to likewise be covered under DBA. This coverage typically consists of expenses associated with medical treatment and loss of wages, along with special needs and survivor benefit. Expatriate insurance coverage offers people and companies operating beyond their house country with protection for automobiles, property, health, liability and organization pursuits. Hired-in Plant Insurance covers liability where, under a contract of hire, the client is responsible to pay for the cost of hired-in devices and for any rental charges due to a plant hire company, such as construction plant and equipment.

When something happens which activates the requirement for legally get rid of timeshare legal action, it is known as "the occasion". There are 2 primary kinds of legal expenses insurance: before the event insurance and after the occasion insurance. Animals insurance coverage is a professional policy supplied to, for instance, industrial or hobby farms, aquariums, fish farms or any other animal holding. Cover is available for death or economic massacre as an outcome of accident, illness or illness but can extend to include damage by federal government order. Media liability insurance coverage is created to cover experts that participate in film and television production and print, versus risks such as character assassination.

">are timeshares worth it has actually taken a chauffeurs education course or is away at college without a car, you might likewise certify for a lower rate.

The key to savings is not the discount rates, but the last rate. A company that offers couple of discounts may still have a lower total price. Federal Resident Information Center National Consumers League Cooperative State Research Study, Education, and Extension Service, USDA.

Due to the litigious nature of our society and the increasing rates of lorries, automobile insurance rates are on the rise throughout the country. The bad news is that insurance isn't likely to come down in cost anytime quickly. Fortunately is that there are things you can do to reduce increases or decrease the burden on your wallet. How to lower automobile insurance!.?.!? Here are 15 various strategies. One of the methods to lower automobile insurance coverage is through a discount rate bulk rate for insuring several cars and chauffeurs simultaneously. Lower vehicle insurance coverage rates may likewise be readily available if you have other insurance policies with the very same business.

How What Is Insurance Premium can Save You Time, Stress, and Money.

If you acquire a quote from an auto insurance company to guarantee a single car, you might wind up with a higher quote per vehicle than if you asked about guaranteeing a number of motorists or cars with that business. Insurer will offer what amounts to a bulk rate since they desire your business. Under some scenarios they are ready to my timeshare give you a deal if it indicates you'll bring in more of it. Ask your insurance representative to see if you certify. Usually speaking, several motorists should live at the same home and be related by blood or by marriage.

If among your motorists is a teenager, you can anticipate to pay more to insure them. However, if your kid's grades are a B average or above or if they rank in the top 20% of the class, you may be able to get a good student discount rate on the protection, which normally lasts until your child turns 25. These discount rates can http://reidfisx355.bearsfanteamshop.com/h1-style-clear-both-id-content-section-0-the-greatest-guide-to-what-is-ad-d-insurance-h1 vary from as low as 1% to as much as 39%, so make certain to reveal proof to your insurance agent that your teenager is a good trainee. Incidentally, some companies might likewise offer an auto insurance coverage discount rate if you maintain other policies with the company, such as property owners insurance coverage.

Simply put, be a safe motorist. This ought to go without saying, but in today's age of increasing in-car distractions, this bears discussing as much as possible. The more conscious you are, the more mishaps or moving infractions you'll have the ability to avoidevents that raise your insurance coverage rates. Travelers offers safe driver discount rates of between 10% and 23%, depending upon your driving record. For those uninformed, points are generally examined to a motorist for moving offenses, and more points can lead to greater insurance premiums (all else being equal). Often insurer will supply a discount for those who complete an approved defensive driving course (How much is gap insurance).